Businesses have unique needs and face specific risks in addition to general risks, what industry are you in?

{getToc} $title={Table of Contents}

Understanding General Liability Insurance

General liability insures businesses across all industries. This comprehensive coverage protects against financial losses caused by bodily injury, property damage, and personal injury claims due to the business's operations or premises. How much it costs

General liability insurance covers claims made by third parties including customers, clients, vendors, or members of the public.

Coverage for Lawsuits Related to Bodily Injury and Property Damage Claims:

If someone gets injured or their property is damaged as a result of your business activities GL will cover legal defense costs, settlements, or judgments associated with these claims. Whether it's a slip-and-fall incident at your retail store or damage caused by your construction activities, general liability is a safety net for the pressures of common mishaps.

Protection Against Personal Injury Claims

In addition to bodily injury and property damage, general liability protects against personal injury claims including claims for libel, slander, defamation, or invasion of privacy. If your business is accused of causing harm through non-physical means, such as making false statements about a competitor, this coverage can help mitigate the financial burden of defending against such claims and any resulting damages.

This Business Insurance Cover Lawsuits

If your business faces a lawsuit the insurance policy will cover the costs associated with legal representation, court fees, and other related expenses. In the event of settlement or judgment against your business, the insurance will help cover the financial obligations ensuring that your business can continue its operations without suffering severe financial strain.

Common Scenarios Where General Liability Insurance Provides Coverage:

- A customer slips and falls in your restaurant due to a wet floor resulting in injuries. General liability insurance will cover the customer's medical expenses and any potential legal claims arising from the incident.

- During a construction project, a worker accidentally damages a neighboring property. The property owner filed a lawsuit for property damage. General liability insurance will cover the legal expenses and any settlements or judgments arising from the claim.

- A customer visiting your retail store is injured by a faulty product and decides to take legal action. General liability insurance will protect your business by covering legal defense costs and any potential settlements or judgments.

Property Insurance Covers Your Property

Property insurance is for physical assets owned or leased by businesses. Its coverage is in the event of damage or loss due to fires, theft, vandalism, or natural disasters. By having property insurance in place businesses can mitigate risks and burdens associated with these unfortunate events.

Coverage for Physical Assets:

Property insurance is for tangible property. This includes buildings, office spaces, machinery, equipment, furniture, inventory, and other tangible property directly related to your business operations. Property insurance ensures that in the event of damage or loss to these assets, you will receive financial compensation to help repair, replace, or rebuild what has been damaged or lost.

For businesses with physical assets property insurance is top of the list. Why not transfer property damage risks to an insurance provider? Property insurance is often required by lenders, landlords, and business partners.

| Physical Property Types Covered | Real Examples |

|---|---|

| Buildings | Office buildings, warehouses, retail stores |

| Machinery and Equipment | Manufacturing machinery, computer servers, construction equipment |

| Inventory | Retail store inventory, restaurant food supplies, warehouse stock |

| Furniture and Fixtures | Office furniture and desks, restaurant seating and decor, retail store displays, and shelving |

| Vehicles | Company cars and delivery vans, trucks used for transportation, construction vehicles, and equipment |

| Tools and Equipment | Power tools used in construction, medical equipment in a healthcare facility, landscaping tools, and machinery |

| Computer Systems and Electronics | Computer workstations and laptops, point-of-sale systems in retail stores, electronic equipment in a manufacturing plant |

| Raw Materials and Supplies | Wood and materials used in furniture production, fabrics and textiles for a clothing manufacturer, building materials for a construction company |

| Merchandise | Retail store products and goods, jewelry and valuable items in a jewelry store, electronics in an electronics retail store |

Workers' Compensation Insurance Safety Net

We are accustomed to seeing people moving fast with smiles on their faces and no care in the world like at Chik-Fil-A. That's because Workers' Compensation laws and the labor movement of the 20th century forged a safer future. Before workers' comp, labor in the United States was extremely dangerous. Some employees were too timid to give their all at work & employers were constantly blaming employees for all kinds of incidents. The 20th century saw a 95% decrease in labor-related fatalities due to unions and labor movement laws.

This safety insurance protects employees and business owners alike. Its purpose is The Great Exchange, providing financial support when employees suffer work-related harm helping them recover and get back on their feet, meanwhile protecting businesses from such lawsuits.

From common workplace accidents like slips and falls to occupational diseases due to long-term exposure, this insurance offers coverage for various work-related medical conditions.

Workers' Compensation Insurance Benefits

Workers' Compensation Insurance is more than just a policy it's a lifeline for employees. It covers medical expenses, ensuring that employees receive necessary treatments without facing substantial financial burdens. Additionally, when employees are unable to work due to their injuries or illnesses, the insurance provides wage replacement benefits, allowing them to focus on their recovery and maintain financial stability during their absence from work.

In the real world, complying with legal requirements is important. Workers' Compensation Insurance is often mandated by law in many jurisdictions i.e. Maryland, ensuring that employees are adequately protected in the event of work-related accidents or illnesses. Complying with legal requirements not only safeguards employees but also protects businesses from potential lawsuits and reputational damage.

Workers' Compensation Insurance is both preventive and responsive.

Professional Liability Insurance

Professional Liability Insurance (PLI), commonly known as Errors and Omissions Insurance, protects professionals when they encounter the consequences of alleged negligence, errors, or omissions committed while rendering their services. Unlike general liability insurance, which covers bodily injuries or property damage, PLI centers on shielding professionals from financial losses arising from claims related to their professional expertise and advice.

Coverage for Negligence, Errors, or Omissions in Professional Services

The crux of Professional Liability Insurance lies in its comprehensive coverage for negligence, errors, or omissions that may inadvertently occur during the course of professional service delivery. When a client perceives that the services provided have not met the expected standards or caused financial harm, they may file a lawsuit against the professional. In such situations, PLI steps in, covering legal expenses, settlements, or judgments, thereby safeguarding the professional's reputation and financial stability.

Importance for Professionals such as Doctors, Lawyers, Consultants, etc.

The significance of PLI spans across a diverse range of professions. For doctors and healthcare practitioners, a single oversight in medical advice or treatment could have grave consequences for patients' well-being, leading to medical malpractice claims. Lawyers, too, face substantial risk, as a mere legal error can alter the course of a client's life, resulting in claims for legal malpractice. Likewise, consultants and other professionals offering expert guidance are exposed to potential claims if their advice causes financial losses to clients.

Protection Against Claims for Financial Losses Resulting from Professional Advice or Services

In an increasingly litigious society, the need for Professional Liability Insurance cannot be overstated. Regardless of how well-versed and proficient a professional may be, there is always a possibility of an error or an unforeseen circumstance leading to financial repercussions for clients. PLI offers a safety net against these unexpected challenges, ensuring that professionals can continue to serve their clients without the constant fear of crippling lawsuits.

Commercial Auto Insurance for Business Vehicles

Like personal, commercial auto insurance also covers theft which is a significant concern for businesses with valuable goods or equipment frequently transported in their vehicles.

Liability Coverage for Bodily Injury and Property Damage

Liability coverage protects businesses from potential legal costs caused by their work vehicles.

If a business-owned vehicle is involved in an accident causing bodily injury or property damage to a third party, the company could face expensive lawsuits and claims. Liability coverage would cover the costs of medical bills, property repairs, and legal fees associated with defending the business in court.

Must-Have for Businesses with a Fleet of Vehicles

For enterprises that operate a fleet of vehicles, commercial auto insurance is not just a luxury but a necessity. A single accident involving one of the fleet vehicles can lead to significant financial repercussions if not adequately insured. Investing in commercial auto insurance ensures that the entire fleet is protected against potential risks, allowing businesses to focus on their core activities without worrying about the financial consequences of an unfortunate incident.

Businesses Using Vehicles in Daily Operations

Even if a business owns only one vehicle for its operations, commercial auto insurance is still essential. Whether it's transporting goods, making deliveries, or farming, these vehicles are vital to the business. A comprehensive auto insurance policy offers peace of mind to business owners knowing that their assets and employees are protected in unforeseen circumstances.

Commercial Crime Insurance Essentials

Scenarios Commercial Crime Insurance Applies:

- Employee Embezzlement: A trusted employee manipulates financial records to siphon funds from the company over an extended period. Commercial crime insurance covers the losses resulting from the embezzlement scheme, enabling the business to recover financially.

- Robbery and Burglary: Armed robbers break into a retail store, stealing valuable merchandise and cash from the registers. Commercial crime insurance steps in to compensate the business for the stolen goods and money, allowing them to resume operations smoothly.

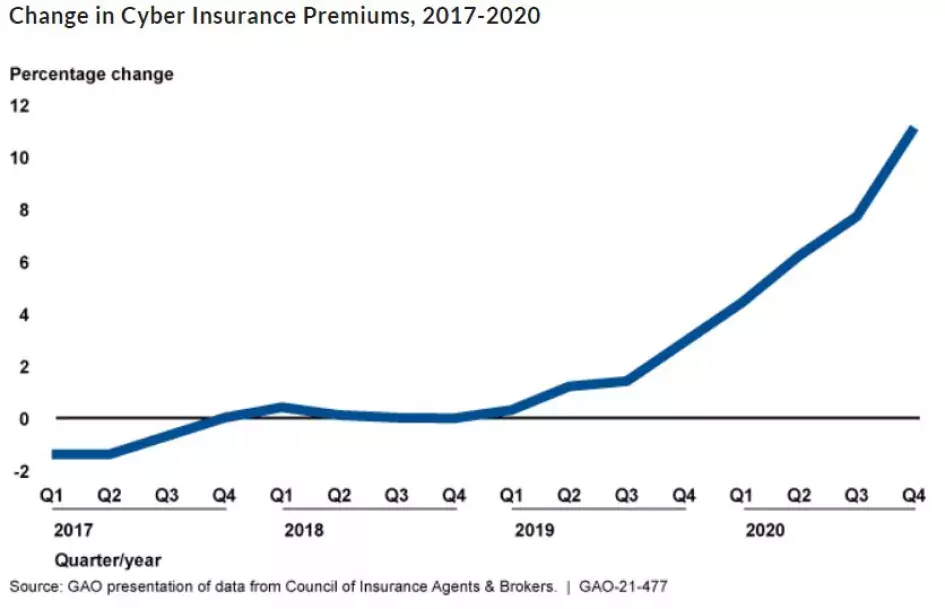

- Cyber Fraud: A hacker infiltrates a company's network, gaining access to sensitive customer information and carrying out fraudulent transactions. Commercial crime insurance covers the losses incurred due to cyber fraud, safeguarding the company's reputation and customer trust.